Counting on the government to bail you out if things get tough?

Counting on the government to bail you out if things get tough?

Why you might want to reconsider—and one simple thing you can do to protect yourself

Are we headed for a recession?

While the unemployment rate is still at historic lows in most parts of the country,[1] and consumers seem pretty optimistic, if their spending is any indication,[2] there could be hard times ahead. According to Bankrate and their Third-Quarter Economic Indicator survey, 90% of the experts they talked to thought the economy was worth being concerned about. (That said, those same experts thought a recession was possible but not likely in the shortish term: on average, they put the likelihood of recession by the 2020 presidential election at 41%.[3])

Would you lose your job in a recession?

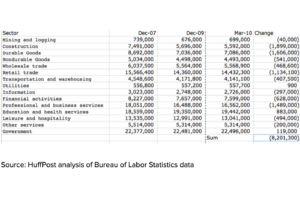

No one can answer that question with any certainty. But according to analysis by the HuffPost, here’s where job changes shook out by industry during the last recession.[4]

The government safety net might offer less protection than you think

Unemployment insurance and disability protection (through Social Security) can be lifesavers—if you qualify.

Unemployment insurance, which varies by state, might not be as generous as you imagine. Although qualified workers were historically entitled to receive some fraction of their paycheck for up to 26 weeks, the deluge of claims during the 2008 recession left many states indebted to the federal government. To avoid a recurrence, nine states reduced their benefits. Florida and North Carolina currently offer the lowest maximum benefit duration with just 12 weeks of protection.[5]

Although there are exceptions, the following typically mean you won’t be able to collect.

- You’re fired for misconduct.

- You’re fired for poor performance.

- You quit your job without good cause.

- You didn’t work the minimum amount of time and/or earn a specified minimum amount of money.[6]

- Independent contractors.

Filing for unemployment benefits can be confusing—and the penalties for filing incorrectly can be expensive and harsh. Check out this article for more on that distressing reality.

Have two jobs and quit one? In some states, that could prevent you from being eligible for unemployment protection if you’re laid off from the second job.[7]

Fail a drug test while you’re unemployed? A new rule proposed by the White House would block workers from getting their unemployment benefits if they tested positive for drug use. Learn more here.

Lose your job because of a disability? You might not be able to count on the government for help. You’ll only qualify for Social Security if you have a medical condition that will last at least a year or result in death.[8] Plus, you’ll only be considered disabled if you can’t do any job, not necessarily the job you held at the time of the disability. You’ll have to wait at least five months before you can start receiving benefits.[9] And, as this summary at Nolo.com captures, you could spend months navigating the system—and still not qualify.

What should you do now? Protect yourself.

Take charge with a policy that offers you three critical areas of protection: disability, involuntary unemployment and salary gap protection. That final element will help if you’re forced to take a job that pays less than your previous one—an all-too-likely possibility, especially if there’s a recession. That combination isn’t available from every provider so do your homework.

Looking for triple-protection coverage?

Investigate the benefits of Wage Protector® for yourself. Its just-right mix of disability, involuntary unemployment and salary gap protection could be just the coverage you need.

Wage Protector® and SALARYGAP® are registered trademarks. The use of trademarks without the express prior written consent by SALARYGAP Partners LLC is strictly prohibited.

[1] Bureau of Labor Statistics. Oct. 4, 2019. As cited by Weller, Christian. 2019. “Even Amid Low Unemployment, Many Workers Struggle to Find a Job.” Oct. 8, 2019. Forbes. https://www.forbes.com/sites/christianweller/2019/10/08/even-amid-low-unemployment-many-workers-still-struggle-finding-a-job/#7cc522b14de2

[2] Federal Reserve. 2019. “University of Michigan: Consumer Sentiment” Aug. 2019. https://fred.stlouisfed.org/series/UMCSENT/ as cited by Hartman, Mitchell. 2019. “Here’s what a ‘good economy’ means to these shoppers” Oct. 9, 2019. Marketplace Accessed October 10, 2019 https://www.marketplace.org/2019/10/09/heres-what-a-good-economy-means-to-these-shoppers/

[3] Foster, Sarah. 2019. “How likely is a recession by the 2020 elections? Here’s what top economists say.” Sept. 16, 2019 Bankrate.com Accessed October 9, 2019 https://www.bankrate.com/surveys/economists-survey-what-they-said-september-2019/

[4] Nasiripour, Shahien. 2010. “Which Industries Lost/Gained Jobs in the Great Recession.” June 5, 2010. HuffPost Accessed October 10, 2019 https://www.huffpost.com/entry/which-industries-lostgain_n_525504

[5] Congressional Research Service. 2018. “Unemployment Insurance: Consequences of Changes in State Unemployment Compensation Laws” March 7, 2018. Accessed October 17, 2019 https://fas.org/sgp/crs/misc/R41859.pdf

[6] Unemployment LawFirms/NOLO. “Possible Reasons for Being Denied Unemployment Benefits.” Accessed October 10, 2019 https://www.employmentlawfirms.com/resources/employment/unemployment/possible-reasons-for-being-denied-unemployment-benefits

[7] Tarr, Joe. 2017. “So long, safety net.” March 2, 2017. Isthmus. Accessed October 9, 2019. https://isthmus.com/news/cover-story/the-state-goes-after-people-on-unemployment-for-making-hones/

[8] Social Security Administration “Disability Benefits” August 2018. Accessed 9-11-19 https://www.ssa.gov/pubs/EN-05-10029.pdf

[9] Social Security Administration. “When Your Benefits Start” Accessed 9-11-19 https://www.ssa.gov/planners/disability/approval.html