Retirement just around the corner? Don’t drop disability coverage yet.

Five important reasons why that money-saving move could cost you

The end of your career is in sight and you’re looking for ways to pump up those retirement savings—hey, every little bit helps! Cutting disability protection out of the budget might seem like a logical choice. But is it?

The odds could look to be in your favor—I’ve gotten this far, what could happen now??? But are those odds you’re willing to play? Here are five reasons you might want to think twice.

-

Disability doesn’t just happen to other people.

Disability can happen at any age and it’s not just something for people in dangerous professions to worry about. The Council for Disability Awareness says illnesses, not accidents, are responsible for almost all disabilities.[i] And the AARP reports one in eight Americans will become disabled for five or more years at some point in their career.[ii]

Could disability be in your future? We don’t have a crystal ball, but the Council for Disability Awareness has a calculator to determine your PDQ, or Personal Disability Quotient. Check it out here.

-

The risk of disability does go up with age.

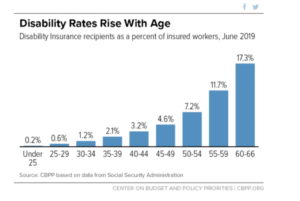

You may have dodged the proverbial bullet so far, but that doesn’t mean you’ll continue to. The likelihood of collecting disability from Social Security doubles from ages 40 to 50 and again from 50 to 60. And the 50s and 60s are years of peak risk for disability.[iii]

Get outta that chair. Here’s a stat worth paying attention to: If you’re 60+, each additional hour you spend sitting increases your risk of physical disability by 50%. And it doesn’t matter how much exercise you get when you’re not sitting.[iv]

Source:

Center on Budget and Policy Priorities. 2019 “Chart Book: Social Security Disability Insurance.” Sept 6. 2019. Accessed Sept. 26, 2019

https://www.cbpp.org/research/social-security/chart-book-social-security-disability-insurance

-

You might not have the protection you think.

Assume you can drop personal coverage because your employer or the government (through Social Security) has your back? Learn more first.

Start with workers’ comp. Whatever causes you to file for disability probably won’t be related to your job. In fact, just 1% of American workers missed work because of an occupation-related illness or injury. [v]

And make sure you understand your workplace disability protection and the realities of Social Security coverage—you might be unpleasantly surprised. Click through to learn more about both.

Think you’ve got disability covered through work or the government? Make sure you understand the following.

Some sort of employer-provided disability protection is relatively common, but short-term coverage is more likely than long-term—42% of private industry employees have access to short-term vs. 34% for long-term.[vi] And whatever coverage your employer is offering is probably a percentage of your base salary. If commissions and bonuses make up a substantial part of your take home pay, that won’t be included.

| Short-term vs. long-term disability insurance

· Short-term typically provides three to six months of coverage. · Long-term can be anywhere from a few years to the rest of your career. |

If you’re lucky enough to have coverage through work, make sure you understand the following.

- What percentage of your salary does your disability insurance cover? Somewhere between 40%-60% of your gross salary is common. Could you live on that?

- How long is your waiting period? This is the amount of time until your disability insurance kicks in. Can you afford to wait it out?

- How does your policy define “disability?” Some insurance will only kick in if you’re not able to do any job—not necessarily the job you were hired for. If you had to go through years of school, training or career building for your current position, it’s important to have an “own occupation” policy. This will cover you if you’re not able to do your current job (and probably isn’t the type of coverage you have at work).

And what about Social Security coverage?

You’ll only qualify for this if you have a medical condition that will last at least a year or result in death.[vii] Plus, you’ll only be considered disabled if you can’t do any job, not necessarily the job you held at the time of the disability. You’ll have to wait at least five months before you can start receiving benefits.[viii] And, as this summary at Nolo.com captures, you could spend months navigating the system—and still not qualify.

-

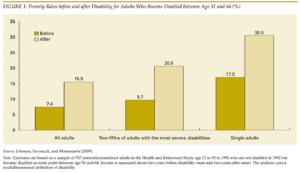

Disability just before retirement can lead to poverty.

A report by the Urban Institute—which is, admittedly, nearly a decade old—found poverty rates for adults aged 51-64 more than doubled following disability. [ix]

Could you pay your bills without a paycheck? Research by the American Payroll Association showed nearly three-quarters of Americans would find it somewhat or very difficult to pay their bills if their paycheck was just one week late.[x] Are you one of them?

-

Disability coverage helps keep you in charge.

You’ve worked hard to protect your assets and your loved ones. A late-career disability without the right protection could derail that and force you to make some hard choices.

Think back to why you got disability protection in the first place. We’re guessing peace of mind was a big part of your decision. Are you willing to give that up now?

What’s the right insurance mix for you as you approach your “golden years”?

Wage Protector® could be the answer. Check out whether its triple-hit of protection—disability, involuntary unemployment and salary gap—could be right for you.

Wage Protector® and SALARYGAP® are registered trademarks. The use of trademarks without the express prior written consent by SALARYGAP Partners LLC is strictly prohibited.

[i] Council for Disability Awareness. 2018. “Disability Statistics” March 28, 2018. Accessed 9-13-2019 https://disabilitycanhappen.org/disability-statistic/

[ii] Garskof, Josh. 2017. “When to Get Disability Insurance.” May 1, 2017. AARP Bulletin. Accessed 9-25-19 https://www.aarp.org/money/investing/info-2017/when-to-get-disability-insurance.html

[iii] Center on Budget and Policy Priorities. 2019. “Chart Book: Social Security Disability Insurance.” Sept. 6, 2019. Accessed 9-26-19 https://www.cbpp.org/research/social-security/chart-book-social-security-disability-insurance

[iv] Poon, Linda. 2014. “Sit More, and You’re More Likely to Be Disabled after 60.” Feb. 19, 2014. NPR. Accessed 9-26-19 https://www.npr.org/sections/health-shots/2014/02/19/279460759/sit-more-and-youre-more-likely-to-be-disabled-after-age-60

[v] Bureau of Labor Statistics, Employer-Reported Workplace Injuries and Illnesses (Annual) 2016, Table1 Incidence rates of nonfatal occupational injuries and illnesses by industry and case types, cases with days away from work. As sited by the Council for Disability Awareness, March 28, 2018. Accessed September 25, 2019 at https://disabilitycanhappen.org/disability-statistic/

[vi] Bureau of Labor Statistics. 2018. “Employee access to disability insurance plans.” October 26, 2018 Accessed 9-11-19 https://www.bls.gov/opub/ted/2018/employee-access-to-disability-insurance-plans.htm

[vii] Social Security Administration “Disability Benefits” August 2018. Accessed 9-11-19 https://www.ssa.gov/pubs/EN-05-10029.pdf

[viii] Social Security Administration. “When Your Benefits Start” Accessed 9-11-19 https://www.ssa.gov/planners/disability/approval.html

[ix] The Urban Institute. 2010. “Disability Just Before Retirement Often Leads to Poverty.” January 2010. Accessed 9-25-19 https://www.urban.org/sites/default/files/publication/28281/412009-Disability-Just-Before-Retirement-Often-Leads-to-Poverty.PDF

[x] American Payroll Association, National Payroll Week 2017 “Getting Paid in America” Survey, 2017 as cited by Griffin, Jeff. 2019. “The Upside of Auto-Enrolling Your Workforce in Disability Insurance.” Aug. 8, 2019. Accessed 9-26-19 https://www.griffinbenefits.com/employeebenefitsblog/dol-expands-auto-enrollment-to-disability-insurance