No one wants to be unemployed. Wage Protector® helps in those situations where workers lose a job through no fault of their own.

Why We’re Different

Supplemental Disability

Our disability policy supplements any other disability policies providing additional security for these individuals

• Many Disability policies offer only partial income replacement

• This is supplemental to other Disability policies

Involuntary Unemployment

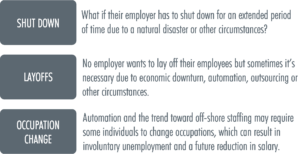

Individuals are covered in case of lay-offs and qualified temporary or permanent shut-down

• Include as part of a comprehensive severance package

• Added level of protection beyond severance package

SALARYGAP®

A Salary Gap event occurs when individuals are rehired at a lower salary after involuntary unemployment

• Protection that may help reduce the length of involuntary unemployment for these individuals.

• Could reduce period of unemployment for workers

• Could assist with career changes due to automation or outsourcing

Wage Protector® coverage can also be offered to spouses or domestic partners

How Do The Benefits Work If A Salary Gap Occurs?

- How Do Disability Benefits Work?

- How Do Involuntary Unemployment Benefits Work?

- How Do SALARYGAP® Benefits Work?

When an Insured:

• becomes disabled from a sickness or injury, is unable to work and is under the care of a physician, benefits are payable directly to the insured without coordination of any other benefits including another disability policy.

Policy Conditions:

• Monthly Benefit Limits: $200-$2,500. The Lump Sum Benefit Limit: up to $25,000 (may not exceed 60% of an employee’s monthly salary and for independent contractors may not exceed 60% of their average monthly income).

• Actively at Work requirement: for 90, 180, 365 Days (Independent Contractor also includes a 730 day option)

• Waiting Period: 7, 30, 60, 90 Days (Retroactive and Non-Retroactive)

• Pre-existing Conditions Exclusion: 6, 12, 24 months

• Maximum Benefit Period: 3, 6, 12, 24 months or 1 Lump Sum Benefit

• Lifetime Aggregate Maximum Benefits: 2, 3, 4 times the Maximum Benefit Amount

• Policy Term: 12, 24, 36, 60 months

When an Insured:

• Is actively at work (30 hours or more weekly),

• has a qualifying event (employer lay-off, strike, lockout, termination or natural disaster) that exceeds the Waiting Period and causes a total loss of income,*

• has applied for and is receiving any state unemployment benefits, Involuntary Unemployment (IU) benefits are payable directly to the insured. IU benefits will be reduced so that IU benefits and any government or private unemployment benefits do not exceed the insured’s income prior to the qualifying event.

Policy Conditions:

• Involuntary Unemployment Benefit: 50% or 100% of Disability Benefit

• Vesting Period: 30, 60, 90, 120, 180 days (number of consecutive days following the policy effective date before an involuntary unemployment event can occur and be eligible for benefits)

• Actively at Work requirement: for 90, 180, 365 Days (Independent Contractor also includes a 730 day option)

• Waiting Period: 7, 30, 60, 90 Days (Retroactive and Non-Retroactive)

• Maximum Benefit Period: 3, 6, 12, 24 months or 1 Lump Sum Benefit

• Lifetime Aggregate Maximum Benefits: 2, 3, 4 times the Maximum Benefit Amount

• Policy Term: 12, 24, 36, 60 months

After an Insured:

• has been involuntarily unemployed for at least the Waiting Period,

• becomes re-employed (30 hours per week for at least 90 days) within the Eligibility Period,

• has a reduction of income of at least the SALARYGAP® Reduction Ratio amount,

SALARYGAP benefits are payable directly to the insured.

• Insured has a qualifying event: employer lay-off, strike, lockout, termination or natural disaster*

Policy Conditions:

• SALARYGAP Benefit: 50 or 100% of Disability Benefit

• Eligibility Period: 3, 6, 12 or 24 months (after completing the Waiting Period, insured must be re-employed within this time period following an involuntary unemployment)Vesting Period: 30, 60, 90, 120, 180 days (number of consecutive days following the policy effective date before a Salary Gap event can occur and be eligible for benefits)

• SALARYGAP Reduction Ratio: 15%, 20%, 25% (the difference between income before an IU occurs and income from replacement employment; for independent contractors, it is the average monthly income)

• Waiting Period: 7, 30, 60, 90 Days (Retroactive and Non-Retroactive)

• Maximum Benefit Period: 3, 6, 12, 24 months or 1 Lump Sum Benefit

• Lifetime Aggregate Maximum Benefits: 2, 3, 4 times the Maximum Benefit Amount

• Policy Term: 12, 24, 36, 60 months